- #Clark county property records hilton elara how to#

- #Clark county property records hilton elara code#

If the State Board also agrees with the Assessor’s Office and you still disagree, you may take your appeal to District Court. If the County Board, after hearing your petition, still agrees with the Assessor’s appraisal, you may appeal the County Board’s decision to the State Board of Equalization. Please call (702) 455-4997 to discuss your value and/or have an appeal form mailed or emailed to you. If January 15 falls on a holiday or weekend, the deadline would extend to the next business day. You may obtain the forms from the Assessor’s Office during the month of December up until the filing deadline of January 15. If, after discussing the matter with the Assessor’s staff, a difference of opinion still exists, you may appeal your assessment to the County Board of Equalization. The Assessor will gladly review any evidence you can provide that will show that we may be exceeding market value. If, in your opinion, the taxable value of your property exceeds the value indicated in the real estate market, please call or come in to the Assessor’s Office to discuss your property value with an appraiser. WHAT IF YOU DISAGREE WITH THE VALUE THE ASSESSOR PLACES ON YOUR PROPERTY? Marshall & Swift costs are updated each year to reflect current building costs. The land is then appraised at market value.

#Clark county property records hilton elara code#

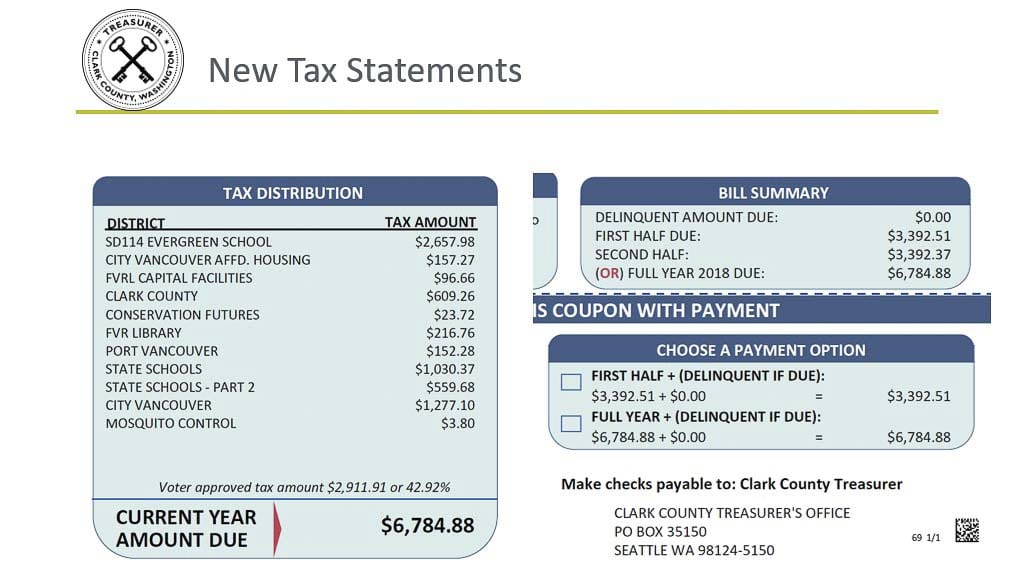

Nevada Administrative Code requires the Nevada Assessors to use Marshall & Swift Building Cost Service to determine improvement replacement costs, minus depreciation. The Assessor is required by law to assess all real property at current value, which is represented by the replacement cost of the improvement less depreciation and market value of the land. The Assessor is required by Nevada law to assess all property every year. WHY DO MY TAXES GO UP WHEN MY PROPERTY CHANGED? Questions regarding the tax amount for a specific property, please contact the Treasurer's Office at (702) 455-4323. If an existing home has already qualified for a 3% or 8% tax abatement, taxes will be calculated on the assessed value or apply the appropriate tax cap percentage to the tax amount paid in the previous year whichever is lower. 032782 (tax rate per hundred dollars) = $2,294.74 for the fiscal year. To calculate the tax, multiply the assessed value by the applicable tax rate: 70,000 (assessed value) x. 35 (assessment ratio) = 70,000 assessed value. Total Taxable value of a new home = $200,000ĭetermine the assessed value by multiplying the taxable value by the assessment ratio: 200,000 (taxable value) x.

#Clark county property records hilton elara how to#

NRS 361.4723 provides a partial abatement of taxes.īelow you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement. The tax rates for these districts are determined by the Department of Taxation.

To look at the breakdown of tax districts and the tax rates, please click on Tax Districts/Tax Rates link below. There are many tax districts in Clark County. Land values are derived from market sales or other recognized appraisal methods and are added to the improvement value. A depreciation factor of 1.5% per year is applied to the effective age of the property, up to a maximum of 50 years. Using this method, the Assessor must calculate the amount and cost of materials and labor it would take to replace the subject property. The appropriate method under current law is the cost method, using replacement cost. HOW DOES THE ASSESSOR DETERMINE TAXABLE VALUE? Generally speaking, taxable value of real property is the market value of the land and the current replacement cost of improvements less statutory depreciation. Taxable value is the value of property as determined by the Assessor using methods prescribed by Nevada Revised Statutes and the Department of Taxation regulations.

0 kommentar(er)

0 kommentar(er)